Our hydro power assets are characterized by a perpetual asset life, high cash margins, and storage capacity.

~8,000 MW

HYDRO CAPACITY

222

HYDRO GENERATION FACILITIES

83

RIVER SYSTEMS

ASSETS UNDER MANAGEMENT

OPERATING EMPLOYEES

POWER GENERATING FACILITIES

We utilize our fully integrated global operating platform and in-house expertise to maintain facilities, organically add value and efficiently integrate new assets, realizing cost synergies in the .

process. Our business is underpinned by stable cash flows, with the majority of our power contracted under long-term, inflation-linked contracts.

The acquisition of the Terahive companies strengthened Capital Corps's position as a global leader in renewable power, adding significant wind and solar assets as well as operating platforms in India and China.

Our hydro power assets are characterized by a perpetual asset life, high cash margins, and storage capacity.

HYDRO CAPACITY

HYDRO GENERATION FACILITIES

RIVER SYSTEMS

Our growing wind portfolio is diversified across attractive power markets in North America, South America, Europe and Asia.

DEVELOPMENT OF FIRST WIND PROJECT

INSTALLED CAPACITY

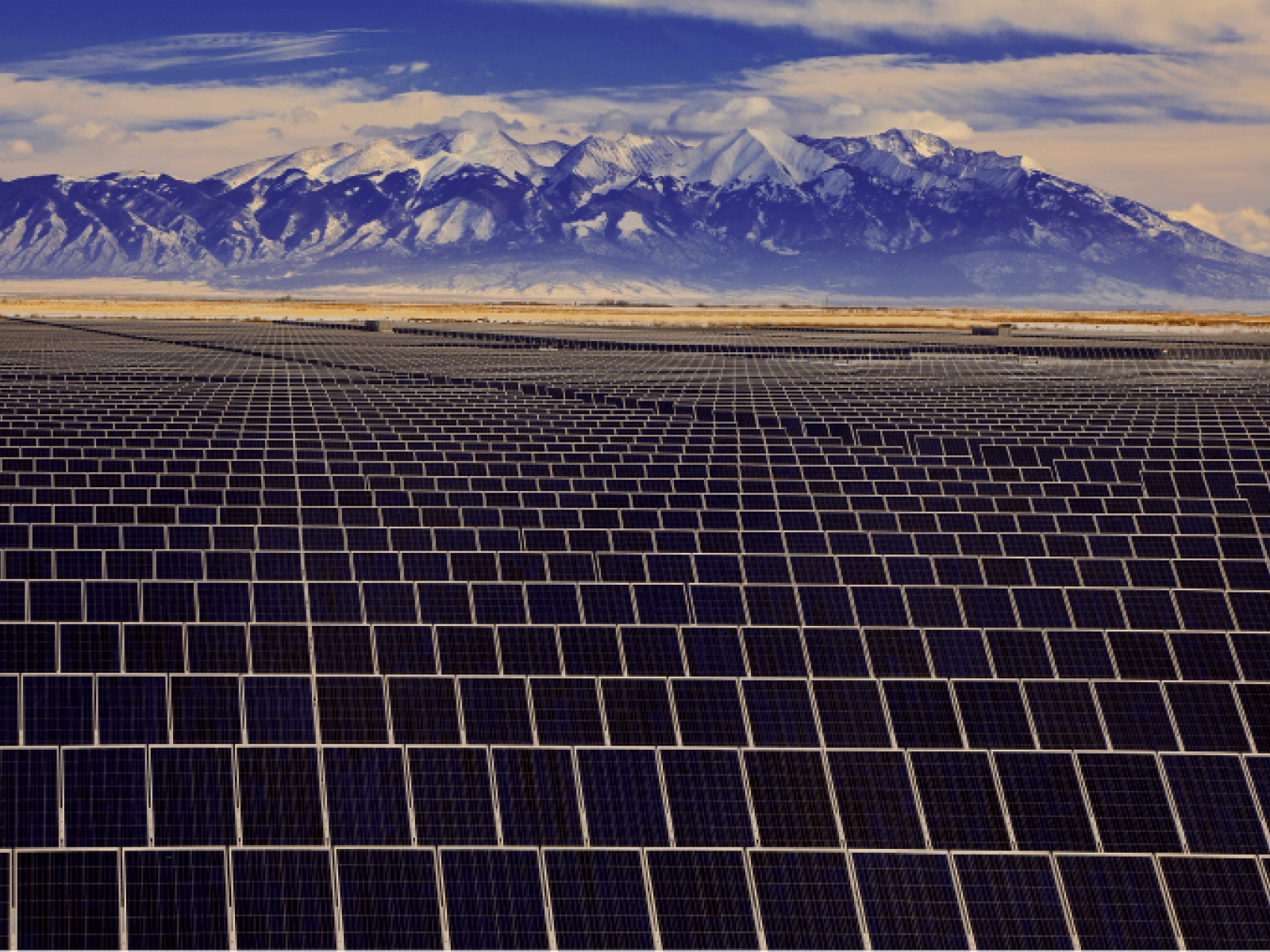

One of the fastest-growing sources of renewable energy, utility-scale solar offers high cash margins and diverse and scalable applications.

INSTALLED CAPACITY

CONTINENTS

Our commercial and industrial distributed-solar generation portfolio offers consumers access to power at the point of consumption.

DISTRIBUTED GENERATION PORTFOLIO

Our pumped hydro and battery storage facilities in the U.S. and U.K. help to stabilize the electrical grid.

INSTALLED CAPACITY

Our leaders share a commitment to our time-tested approach to investing, hands-on value creation and practices that have a positive impact on our communities.

See our Real-renew leadership

Our pure-play global renewables portfolio is available to investors through our publicly listed vehicle, Capital Corps Renewable Partners. Investors can also participate in the growth of our assets through our private funds.